The Revenge of the Revenue Hoarders

The legislation to implement the government’s promised tax cuts will be introduced to parliament next week, but like a zombie army immune to intelligent argument, the advocates of increased Commonwealth revenue hoarding are not beaten yet:

WAYNE Swan has called an end to the Howard government policy of returning excess budget surpluses as tax cuts, saying the Reserve Bank had been allowed to shoulder too much responsibility for controlling inflation with interest rate rises.

The Treasurer said that under the Rudd Government, any windfall revenue would be allowed to mount up as a larger budget surplus and would be quarantined, either with the Reserve Bank or the Future Fund.

“We will be banking any upward revisions to revenue, if they occur,” he told The Australian.

Mr Swan said the previous government placed too much emphasis on the use of interest rates - or monetary policy - to control inflation, and did not do enough to control the budget with fiscal policy.

“Monetary policy is a blunt instrument and that is why it is really important that fiscal policy plays a bigger role,” he said.

This has things exactly backwards. It is fiscal policy that is the blunt and unwieldy policy instrument and Australia’s current inflation problem is first and foremost a failure of monetary not fiscal policy.

Increased Commonwealth revenue hoarding also runs counter to Treasury advice, which points to the positive implications for labour supply and potential output of lower taxes. If the previous government had not cut taxes, labour market constraints would be an even greater threat to inflation and interest rates than they are now. By contrast, Commonwealth revenue hoarding has no pay-off in augmenting the supply-side of the economy.

posted on 08 February 2008 by skirchner in Economics, Financial Markets

(9) Comments | Permalink | Main

Australia’s Fiscal Gang Problem

Finance Minister Lindsay Tanner says ‘Australia has a gang problem, and I’m part of it.’ He is referring, of course, to the ‘razor gang.’ Tanner was announcing a ‘modest down payment’ of $643m in budget cuts, ahead of larger cuts to be announced in the May Budget. No doubt the aim of this announcement is to be seen to be doing something about inflation in the week of an increase in official interest rates. Among the causalities are some of the former government’s more outrageous pork-barrelling projects, including the Fishing Hall of Fame and the National Rugby Academy.

The more significant cuts will take longer to put together, but the returns to what has supposedly been a line-by-line examination of government spending programs are already looking rather paltry. They are also small relative to the enormous amount of political capital the government has available to spend in the wake of its election victory. One suspects that the legendary Lu Kewen could literally spit on some voters at the moment and still have them come away thinking it was a religious experience. When it comes to cutting spending, there is no time like the present.

We previously noted that the new Labor government’s target for the underlying cash surplus of 1.5% of GDP for 2008-09 was not exactly ambitious, merely maintaining the status quo on recent budget outcomes and representing only a small contractionary impulse on forward estimates that probably would have been bettered anyway. The ugly reality for the government is that Commonwealth fiscal policy is already the tightest it’s been in two decades and further spending cuts of the magnitude being contemplated by the government will not put a dent in inflation or interest rates.

posted on 07 February 2008 by skirchner in Economics, Financial Markets, Politics

(0) Comments | Permalink | Main

Hot Ladies Talk Money with Bald Dudes

Jon Stewart’s take on financial TV.

posted on 07 February 2008 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

Another Own Goal in the ‘War on Inflation’

Fighting inflation – with higher tariffs:

The Rudd Government is looking at the possibility of a tariff freeze, in a bid to protect Australia’s remaining car makers, after Mitsubishi confirmed the closure of it’s Australian manufacturing operations with the loss of 930 jobs, according to media reports.

The automaker’s departure is expected to prompt the federal government to carry out a review of subsidies allocated to the industry, as players left in the local automotive sector struggle to cope with increased global competition and a shrinking share of the market.

Car industry tariffs are due to be cut from 10 per cent to 5 per cent by 2010, but manufacturers have asked the government to maintain the current protection and boost funding for the industry.

posted on 06 February 2008 by skirchner in Economics, Politics

(0) Comments | Permalink | Main

Building Approvals, House Price Inflation and Rents

If you thought the double-digit annual growth rates for established house prices in the December quarter were impressive, then you should be even more impressed with the December building approvals release. Private house approvals fell off a cliff, with the overall level of approvals at its lowest since September 2005.

In financial markets, it is common to give the building approvals release a demand-side interpretation, but the supply-side implications are more compelling in the current environment. The strong increases in dwelling rents, a direct contribution to CPI inflation, and house prices are symptomatic of a national shortage of dwelling stock which, on these numbers, is not about to be eased any time soon. Of course, rising rents and house prices should eventually induce an increase in approvals and supply. The November release seemed to herald exactly that, but those gains and more were given away in December. It remains to be seen how much of this is just one-off month on month volatility. The fact that Christmas fell on a Tuesday may have been a factor. There would not have been many people working Monday and, knowing council workers, it is hard to imagine too many hanging around on the previous Friday afternoon either, so there may be a trading day effect that is not picked-up by the usual seasonal adjustment process.

In any event, together with yesterday’s increase in official interest rates, the implications for housing affordability are fairly dire. During the previous boom in house prices earlier this decade, many people decried the tax breaks on investment property and predicted massive over-supply and a subsequent crash in property prices. Yet at best we saw a flattening in prices at the national level, suggesting that the national housing market was never seriously oversupplied. In the absence of the augmentation of the housing stock that we saw as a result of the previous boom and the concessional tax treatment of capital gains on investment property after 1999, the supply situation, housing affordability and inflation outcomes may have turned out even worse than they are now.

posted on 06 February 2008 by skirchner in Economics, Financial Markets

(1) Comments | Permalink | Main

Better Late than Never

From today’s RBA statement on official interest rates:

In future meetings, the Board will continue to evaluate whether the stance of policy will be sufficiently restrictive to return inflation to the 2-3 per cent target.

One would have hoped that the RBA might have performed this evaluation properly before inflation moved outside the target range.

posted on 05 February 2008 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

In Bed with Sharon Burrow

What do opposition Treasury spokesman Malcolm Turnbull and ACTU President Sharon Burrow have in common?

Mr Turnbull:

“I have said before and I will repeat again that I think there are powerful reasons for the Reserve Bank to hold its hand at this meeting.

“There is a lot going on in the international markets and we have inflation running at around that 3 per cent mark at the moment in Australia.”

Ms Burrow:

“It should wait and see on interest rates until the effect of the turmoil in the United States caused by the sub-prime housing market is clearer,” Ms Burrow said.

It is of course precisely the lack of interest rate rises from the RBA that has been the main cause of Australia’s inflation problem.

posted on 05 February 2008 by skirchner in Economics, Financial Markets, Politics

(0) Comments | Permalink | Main

An Own Goal in the ‘War on Inflation’

The Rudd government seeks to fight inflation and promote housing affordability – by giving people more money to spend on housing. This is good news for incumbent property owners, who will see the increase demand for housing capitalised into house prices, but will only worsen housing affordability.

According to the government:

First Home Saver Accounts are also part of the Rudd Government’s five point plan to win the war on inflation, encouraging private savings [sic] and helping put downward pressure on inflation and interest rates.

This initiative will help boost national savings [sic], with the accounts anticipated to hold around $4 billion in savings [sic] after four years.

It is more likely the scheme will simply see substitution between different types of private saving, with households diverting funds from other types of saving to take advantage of the government co-contribution, with no gain to overall private or national saving. As we argue here, the level of domestic and national saving is only a minor influence on interest rates in a small open economy like Australia.

posted on 04 February 2008 by skirchner in Economics

(1) Comments | Permalink | Main

Australian versus US House Prices

The December quarter ABS established house price index saw the weighted average for capital cities rise 3.2% q/q and 12.3% y/y. Perth once again underperformed the other capital cities, with growth of 0.9% q/q and 1.1% y/y, coming down off the massive near 50% y/y growth rate seen for the year-ended in September 2006. Sydney rose 2.4% q/q and 8% y/y, giving a very respectable 5% y/y real return after headline inflation. All the other capitals recorded double-digit annual percentage gains in house prices, with house price growth in Melbourne, Brisbane and Adelaide standing around 20% annually.

For all the talk of a house price bust in Australia a few years ago, Sydney was the only state capital to record an outright decline in house prices at an annual rate, although Melbourne got close with a modest 0.4% y/y rate in the year to December 2004. Many of Australia’s capital cities did, however, experience house price disinflations that were far more dramatic than anything experienced in the US as part of its so-called housing ‘bubble.’

This raises the obvious question as to why house price swings in the US that are relatively modest by Australian standards have had much more adverse macroeconomic consequences in the US. The answer most probably lies in the distinctive features of the US mortgage market. The Australian market is much better conditioned to pronounced cycles in house prices, inflation and interest rates. The lesson is that dramatic house price disinflations or deflations in themselves need not be a serious macroeconomic problem. The more important issue is how these swings interact with, and get propagated through, the financial system.

Australia is a price-taker in global capital markets. The US is an effective price-maker, which means it has the capacity to export financial shocks that have their origins in the non-traded goods sector of the US economy. There has been some pass through of this shock to Australian retail lending rates, as Australian borrowers compete with the rest of the world for scarce liquidity. But this shock to retail lending rates can be traded-off against changes in official interest rates. It has long been argued that Australia’s negative net international investment position left it vulnerable to negative external financial shocks, but the current episode suggests that Australia’s vulnerability to international credit shocks has been greatly exaggerated.

posted on 04 February 2008 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

‘Unrepentant’

posted on 01 February 2008 by skirchner in Culture & Society, Economics, Financial Markets, Foreign Affairs & Defence, Higher Education, Misc, Politics

(0) Comments | Permalink | Main

The Content of Krugman’s Character

Dan Klein and Harika Bartlett have produced a content analysis of Krugman’s New York Times columns, published in Econ Journal Watch:

I maintain that the tension between Krugman’s NYT corpus and economic betterment is strong enough to present problems either way. If Krugman would deny that there is significant tension, then he functions irresponsibly, in ways indicated below. If Krugman would admit that, to some extent, he is ready to sacrifice poor people’s interests for the sake of social-democratic values, then he has to admit conflict among relevant values and give up posturing to the effect that he has been a voice of unbiased research and has stood above any ideological interpretation of affairs.

posted on 29 January 2008 by skirchner in Economics

(0) Comments | Permalink | Main

Peak Oil Nutters

The WSJ profiles some typical Peak Oilers:

It was around midnight one evening in November when Aaron Wissner shot up in bed, jolted awake by a fear: He wasn’t fully ready for the day when the world starts running low on oil.

Yes, he had tripled the size of the garden in front of the tidy white-clapboard house he shares with his wife and infant son. He had stacked bags of rice in his new pantry, stashed gold valued at $8,000 in his safe-deposit box and doubled the size of the propane tank in his yard.

“But I felt panicky, like I needed more insurance,” he says. So the 38-year-old middle-school computer teacher put on his jacket and drove to an all-night gas station, where he filled three, five-gallon jugs with gasoline.

“It was a feel-good moment,” says his wife, Kimberly Sager. “But he slept better.”

Not sure how a few bags of rice, a propane tank and a few grand in gold is meant to help with TEOCAWKI, but like they say, whatever helps you sleep at night.

At least someone is out there trying to give the peak oilers an education:

Three weeks after their first immersion, the couple drove to a peak-oil conference in Ohio, where lecturers showered them with statistics on demand curves and oil-field depletion rates. Then, at a conference in Denver, a man in a chicken suit called them crazies as he passed our fliers arguing that the world still has plenty of oil.

I’m with chicken suit guy.

posted on 26 January 2008 by skirchner in Culture & Society, Economics, Financial Markets

(2) Comments | Permalink | Main

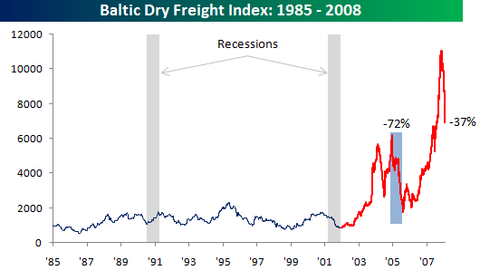

Who Killed the Baltic Dry Index?

The Baltic Dry Index gets a lot of attention as a leading indicator and the signal it’s sending at the moment is certainly bearish. The index is 37% off its peak, having recorded some of its biggest one-day declines in the history of the series dating back to 1985. But a number of caveats are in order.

First, the index is US dollar denominated, and the November peak coincided with the lows in the US dollar index. Since then, the Curse of the Economist Magazine Cover has worked its magic and the US dollar index is off its lows. So at least some of the decline can be attributed to straightforward valuation effects.

Second, the massive run-up in the index probably tells us as much about supply constraints in the international shipping industry as it does the demand for commodities. Like most people, the shipping industry was caught short by the global commodities boom and building extra capacity will take time.

Third, as the following chart from Bespoke Investment Group shows, while previous recessions have been preceded by a downturn in the index, there are many more downturns in the index than there are recessions, including a much more dramatic downturn in 2004-05.

posted on 24 January 2008 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

A Virtual Bank Run

Second Life suffers a real life banking system crisis:

the San Francisco company that runs the popular fantasy game pulled the plug on about a dozen pretend financial institutions that were funded with actual money from some of the 12 million registered users of Second Life. Linden Lab said the move was triggered by complaints that some of the virtual banks had reneged on promises to pay high returns on customer deposits…

The shutdown has caused a real-life bank run by Second Life depositors. Though some players managed to get their Linden dollars out, others are finding that they can no longer make withdrawals from the make-believe ATMs. As a result, they can’t exchange their Linden-dollar deposits back into real dollars. Linden officials won’t say how much money has been lost, but a run on another virtual bank in August may have cost Second Life depositors an estimated $750,000 in actual money.

The WSJ profiles one of the Second Lifers affected:

“Everyone thinks that because you’re losing play money, it excuses everything, but it’s convertible to real money,” says a Second Life player whose avatar is named UpMe Beam. On Sunday night, the female character was wandering topless through the virtual lobby of a Second Life bank called BCX Bank, where a sign said it was “not currently accepting deposits or paying interest.”

In real life, UpMe Beam is a man who says that he is a certified public accountant who has audited banks.

posted on 23 January 2008 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

Who Lost the ‘War on Inflation’?

The December quarter CPI is nothing less than disastrous. The 3.6% y/y average outcome for the statistical underlying measures is the worst result for underlying inflation since the great disinflation of the early 1990s and well above the 3.25% forecast in the RBA’s November Statement on Monetary Policy. It is sobering to recall that these measures are preferred by the RBA because they capture the persistent component of inflation that forecasts future inflation outcomes.

The government talks about a ‘war on inflation,’ but that war was lost by the RBA long before today’s CPI release. Amid all the finger-pointing between the federal government and opposition, few have bothered to point out that the Reserve Bank is the only public institution in Australia with a specific mandate to control inflation. Inflation is not some unfortunate exogenous event, unrelated to past monetary policy actions. The inflation target breach tells us that the RBA was not doing its job properly 12-18 months ago. In the US, the current and former Fed Chair are widely criticised for their supposed role in financial market problems not of their own making. Yet in Australia, the RBA’s senior officers still enjoy almost unimpeachable authority while at the same time failing to meet their core mandate.

If the RBA’s November Statement on Monetary Policy forecasts were realised, the RBA could perhaps have sat on its hands with a view to riding out the inflation target breach over the next 12 months and hope that international and domestic growth weaken sufficiently to return inflation to target in 2009. The risk in doing so is that the RBA ends up validating an acceleration in domestic inflation, requiring an even more aggressive tightening response down the track, with greater downside risks for the domestic economy. The tragedy of the RBA’s policy error on inflation is that it now has much less flexibility in responding to the deteriorating global growth outlook. The RBA can be expected to raise rates at its February Board meeting, despite continued equity market volatility and aggressive Fed easing.

posted on 23 January 2008 by skirchner in Economics, Financial Markets

(7) Comments | Permalink | Main

Page 53 of 97 pages ‹ First < 51 52 53 54 55 > Last ›

|